Failure to understand the unique relationship of managed futures to every other asset class could cost you a lot of money. The main objection I receive from perspective clients on adding managed futures to their portfolio is that they believe that stocks will continue higher. They don’t want to add an asset class that only makes money when the stock market is experiencing a crisis in performance. But, that’s not true. That would indicate an investment with a negative correlation to the equities markets. Managed Futures has generated a near zero correlation of -0.06 since 2000. (Source: BarclayHedge 2017).

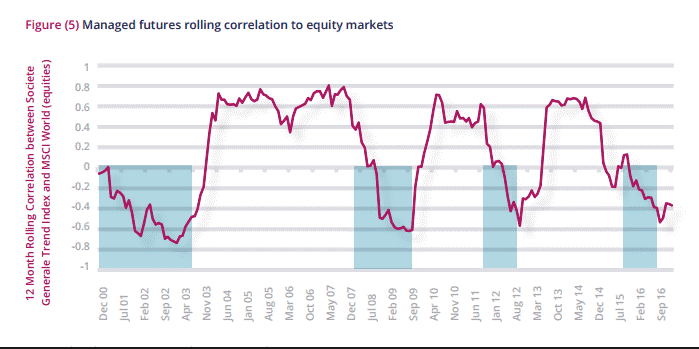

One might assume that trend-following managed futures with zero correlation would just move randomly in relationship to the equities market, but it is so much better than that. The relationship is not static—far from it. Over the last 17 years the correlation has ranged broadly back and forth from highly positive +.8 to strongly negative -.8 while spending very little time around the zero-correlation line.

In the graphic above, the shaded areas indicate those periods when world equities showed a negative return over 12-month periods. Managed Futures demonstrated a very low correlation to stocks during those periods, however when world securities returned to profitability, the correlations jumped up to the +.4 to +.8 range, indicating the potential to produce positive returns in both environments.

So, it is not only that managed futures uniquely has a near zero long term correlation to the equities markets, it is also that trend-following, the main driver of managed futures, sometimes aligns itself with stocks, hedge funds, real estate and private equity, (think the unexpected election of Trump) but at other times zigging when they zag (think the recession of 2008). For these reasons the addition of managed futures trend-following programs makes sense in lowering risk and increasing the potential of profitability at every level.

Dr. Harry Markowitz, author of Modern Portfolio Theory and Nobel Prize winner, demonstrated that investors failed to account correctly for the high correlation among security returns. The same can be said for asset classes such as hedge funds, private equity, fixed income and real estate which have been moving in near perfect correlation to equities, +.87% since 2006. (Source: BarclayHedge 2017) It was his position that a portfolio’s risk could be reduced and the expected rate of return increased, when assets with dissimilar price movements were combined. Holding securities or other asset classes that tend to move in concert with each other does not lower your risk. Diversification, Markowitz concluded “reduces risk only when assets are combined whose prices may move inversely, or at different times, in relation to each other.”

According to Barclay Hedge, one of the oldest and most respected providers of alternative investment data, out of the total $1.78 trillion invested in alternative investment strategies managed futures is #1 surpassing all other investment strategies based on assets under management despite its under performance since 2014.

Why are managed futures so popular with investors? According to Sol Waksman, founder and President of BarclayHedge the “current growth in managed futures assets has been more closely aligned with changing sentiment among sophisticated investors, who are now seeking transparency, liquidity and lower downside volatility within their portfolios, all of which managed futures can potentially provide.”

— Tom Reavis

The content of this article is based upon the research and opinions of Tom Reavis.